EN guest editor Phil Soar tells us why the world of exhibitions revolves around private equity

This article was originally published on EW-sister title EN

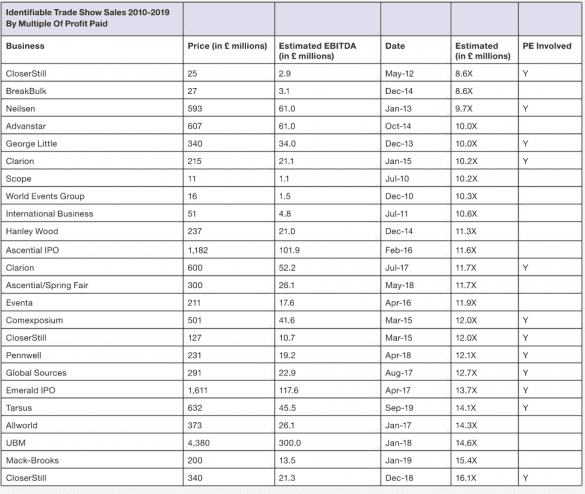

There were 25 significant acquisitions of trade show businesses recorded in the UK between 2010 and 2020. Of these 25, no fewer than 15 were either sales or purchases by a private equity (PE) company. Of the many other smaller and thus unpublicised deals in those ten years, the majority were by businesses owned by PE – notably Clarion, Tarsus, CloserStill, Roar, Nineteen, Emerald, NEC and Comexposium.

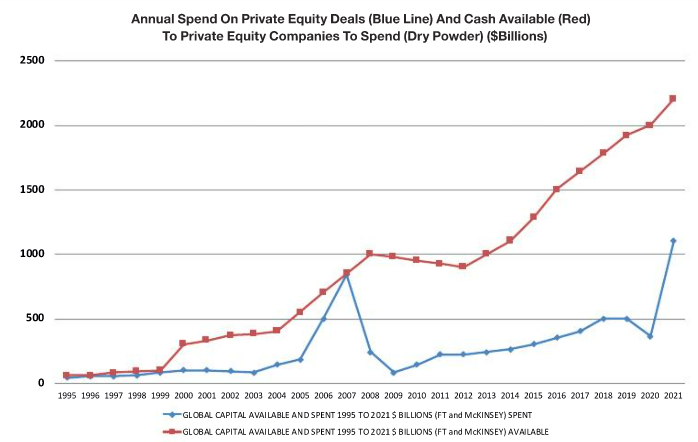

As recently as 2000 PE was a tiny part of the financial world – with total deals that year reaching around $90bn (that may sound a lot, but it is less than one twenty thousandth of US annual economic spend).

But 20 years later, in 2021 alone, PE companies are estimated to have spent in excess of one trillion dollars (that is $1,000bn) on deals. Deals in the UK amounted to £21bn of that amount. Even more remarkable, in January 2022 PE companies were estimated to have more than $2 trillion in “dry powder” – in other words money sitting there available to spend. More money was spent, and more deals were done, in 2021 than in any other year, ever. Which, when one considers that much of the world’s economy was closed down for 18 months, is a truly in jaw-dropping fact.

Just to try to put that $2.2 trillion PE has available into some sort of context – it would pay the wages of 6m British workers for a year; or you could buy 7m Nissan Qashqai’s with it – which is the next 24 years production in Sunderland.

I should stress that there are varying estimates of the total deals done annually by PE and venture capital, and the amounts spent by hedge funds. The quantum does vary somewhat but the broad thrust and direction of travel remains constant. I generally quote the numbers from the FT and McKinsey.

Yet it is probably fair to say that most people in our industry have no direct experience of PE or understand what it is.

So, a simple primer for private equity

If you know, you can skip the next few paragraphs.

As recently as the 1990s there were three basic ways of raising capital for a business or an acquisition. The first was personal wealth – usually of friends and family. The second was a bank loan. As long as you were prepared to place your house on the line as collateral, your friendly local bank manager would lend you start-up money for your business. Third was to go to the stock market. If you had a decent three year trading record, and a London or New York trading house like Goldman Sachs or Barclays was prepared to support you, you could sell equity (shares) to anyone who wanted to buy them. In return, the buyer got a slice of your company. That was the way almost all big companies in London and New York were funded.

The biggest players in the UK market – Reed, EMAP, United (forerunner of UBM), ITE were all quoted on the London Stock Exchange – and Blenheim floated there in 1991 to generate funds for expansion.

But after around 2000 the financial world began to change. Between 1999 and 2021 the number of companies which were quoted on the London Stock Exchange fell from more than 4,000 to just 2,009 in January 2021. The New York exchanges all showed similar declines with half their quoted companies disappearing. The total value of all the companies traded on the London Stock Exchange at the end of 2021 was £3.9 trillion. That compares with the £1.7 trillion in cash alone (ie not including any businesses which PE owns) which PE held on that date. In other words, if they borrowed half the cost, the large PE companies could buy all 2,009 companies quoted on the London Stock Exchange – and do it simply with money they already have available.

What about the rest of the financial world – how is that doing?

PE is only part of the broad financial marketplace. In 2021 just over $6 trillion was spent on all merger and acquisition deals which were publicly announced (to reinforce that number – it is $6,000,000,000,000). PE spent $1 trillion of that – so assuming that the PE deals added 50% debt, then PE’s share would be $2 trillion. So roughly one third of all acquisitions and other deals in 2021 were made by PE.

The rest are, of course, quoted stock exchange companies buying other companies – the largest deal completed in 2021 was Discovery buying Warner Media for $43bn.

Why you can’t buy a house in Clapham?

So who gets rich? Well, above all others the investment banks who “advise” on these deals. They took home $157bn in fees on these deals. If you want to know why you cannot buy a house in Clapham or afford the private schools in Richmond, then the law firms and accountants who also worm their way into every single acquisition or issue of shares also generate enormous fees for this work on mergers and deals. The accounts of Deloitte, the largest accountancy firm, suggest that it earned $6.5bn in fees advising on deals in 2021. And that is just one firm.

If something can’t go up forever, it will stop

Which is, of course, the big question. Already in 2022 we have seen a big stock market correction (broadly 14% at the time of writing, with firms like Facebook and Netflix falling over 25%) and interest rates on the rise (generally asset prices fall when interest rates rise). So, are the good times coming to an end? Paul Taubman, of PJT Partners, says not.

To quote: “What’s been driving this activity is the incredible transformation we are seeing around the globe. You have this digitalisation trend, which is speeding up, not slowing down. You have the decarbonisation trend, the electrification trend, you have so many macro-trends where companies need to re-position their businesses.” And there is still that wall of money.

So how did private equity take over the world?

Well, not by design. As the traditional Western nations became richer, there was simply more cash looking for a home. Other countries, particularly China, reinvested the money they got from selling clothing and mountain bikes, back into the US financial markets – generating billions of “loose” cash looking for a home. Pension funds, in particular, found themselves searching for ways to generate better returns. More and more money was pouring into pension funds as societies became richer – and, in particular, as the baby boom generation prepared for retirement.

Pension funds have long term obligations and had to deal with pensioners living longer and investing more. Interest rates in the US (the rest of the world was similar) fell from a high of 20% in 1980 to around 1% after the 2008 financial crisis. Pension funds and mutual funds (unit trusts) could no longer get decent returns by just putting their money into the bank or government gilts.

This issue of “surplus cash” won’t stop any time soon. The world is ageing fast. No Western country has a replacement birth rate of more than 2.1. By 2050 more than 45% of the UK’s population will be over 50 – and these ageing groups will all be saving for their retirement.

Add to this the sovereign wealth funds – the amounts of money accumulated by many states, often from oil sales. Take one small state, Norway, a country of 5,379,000 people. It has a fund of $1.3 trillion. That is the equivalent of $242,000 for every Norwegian. And everyone with any cash to invest faced the same problem.

So a group of what we might call “investment managers” (IM) began to offer solutions. They go by various names. Venture capital will invest funds in new ideas – most famously in Silicon Valley. Hedge funds offered high-tech software driven investments geared to exploiting small (or sometimes large) differences in financial situations. PE acquires existing companies, borrowing most of the cost as interest rates fell in the 2000-2020 period, and seeks to improve those businesses either by cutting costs, making more acquisitions or installing new management to improve the companies.

The US Securities and Exchange Commission reports on what they call private funds every quarter and groups venture capital, hedge funds and PE together. The term ‘public funds’ is also one you will increasingly hear – it covers all of these businesses which invest in all sorts of assets without the heavy oversight of quoted stock markets.

A very superficial guide to how it works

PE started small in the 1990s, with tiny amounts raised (typically say $10m from a few friendly pension funds or banks). But little by little they showed that they could get far higher returns than a bank account or the stock market.

IMs do not seek to buy and hold a business for ever. Typically they might raise funds from investors for a five year period. They buy businesses in that period but promise to sell those businesses and return the money (plus any profit) to their investors at the end of the five year period.

Although there are a large number of different analyses, the most comprehensive estimate of PE returns which I know is the US Private Equity Index provided by Cambridge Associates. It shows that private equity produced average annual returns of 10.48% over the 20-year period ending on June 30, 2020. During that same time frame, the Russell 2000 Index, a performance tracking metric for smaller companies, averaged 6.69% per year, while the S&P 500 (the 500 biggest companies in the USA) returned 5.91%.

While the difference between 10.48% and 6.69% may not seem too large, if you had invested £1,000 in Private Equity on 1 January 2000, by 31 December 2020 you would have £7,326 as opposed to exactly half – £3,625 –in the stock market.

Buy your daughter a place at Harvard – and help fund private equity

Given that banks were paying very little interest on deposits, and the number of companies which you could invest in on the stock market were disappearing fast, PE and the big holders of cash were made for each other.

It wasn’t just pension funds. Universities and local authorities commonly sit on large amounts of cash. The Harvard University endowment fund (principally gifts from alumni and the rich trying to smuggle their offspring into the university) currently has $53bn in assets, Yale $42bn. That money has to go somewhere. (The largest in the UK is the Cambridge Colleges with £7bn – a typical university like Southampton has £13m).

If you have a pension, you are probably already an investor in private equity

I apologise for such a brief summary of a complex world. But the truth is that if you want to invest serious money today you go to PE or venture capital. If you are selling a business, then it is most likely PE will buy it. This affects everyone. Most people reading this paragraph will have a pension fund managed by someone like Aviva or Standard Life. They will be putting some of your pension into PE. So you are very much part of this investment world.

In a particularly comical development, many PE firms are now seeking to be quoted on the public stock exchanges in London and New York. They are inviting investors to take a slice of their business via the public markets (and by doing so are, of course, making it possible for the managers of the PE companies to sell their own shares in the open market). The irony, of course, is that PE has succeeded by offering a more successful alternative to traditional stock markets and is now going back to those very markets to cash in.

How private equity now borrows money even more cleverly

Things are getting even more complicated. Many PE companies and public funds are now quoted on stock exchanges and borrow money from banks directly. What’s new? You might ask. Well, this is very new. The historical (and very profitable model) has been typically the following:

PE company buys an asset (maybe a trade show company). To do so it puts up perhaps 30% of the money from its own cash and the other 70% it borrows from specialist banks. It the past decade those borrowings have generally been at an interest rate of circa 6% (just like a house mortgage in other words). As security, the banks have the first call on the value of the asset when it is sold (again, just like your house mortgage).

But in the past year at least three PE firms have borrowed money from the markets directly without that money being linked to any particular asset purchase or deal. They have each borrowed sums north of $1bn secured on their own business – not on any particular company which they own or deal they might do in the future. They have been able to borrow at around 3%. The benefit is obvious. Next time they buy a trade show company, instead of paying an outside bank 6% on (say) $300m of borrowings, they lend the money to themselves, but at 3%. In a single year on that deal they save 3% (6% minus 3%) – which is $9m a year. Simples. That’s not peanuts.

How more and more is being paid for assets by pe

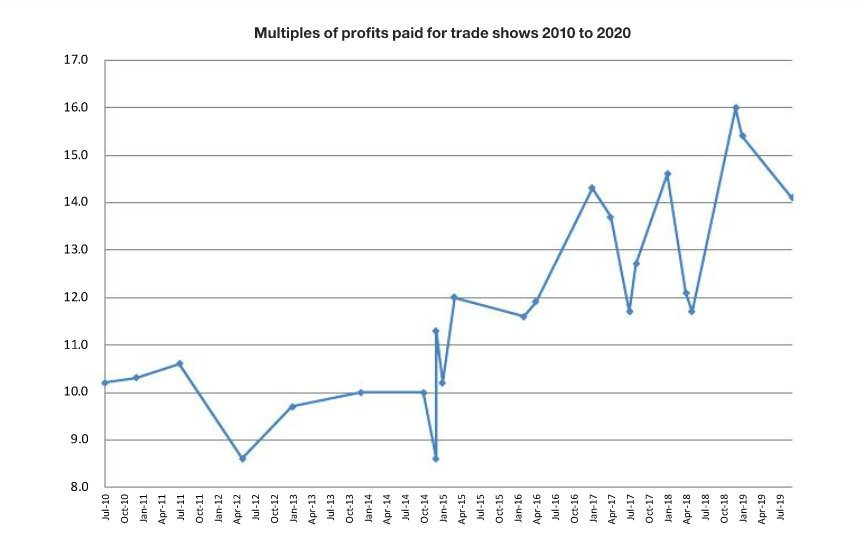

Around 2004 PE paid, on average, 7.4 times profits for a business. By 2020, this had almost doubled – to an average of 13.17 times profits for a business. This is for any and all businesses, not just trade show companies.

In part this general trend line is due to interest rates continuing to fall (thus making borrowing money to buy the asset cheaper). But it is more a function of the sheer wall of money. As we have seen in our other charts, in 2004 PE had some $400bn in dry powder to spend. By 2021 this had reached $2,200bn. From 2008 onwards governments have been pouring money into the western economies to try to support them after the financial crash and, more recently, the pandemic. That money has to go somewhere.

I could produce very similar graphs of all sorts of other assets – artwork, Ferraris, wine, bitcoin, and obviously housing (house prices in Florida have risen 45% in just two years). The trend lines are all very similar and reflect the wall of money.

What has happened to the value of exhibition assets in the past 10 years?

In the period 2010 to around 2014, Trade Show companies sold for around 10 times their EBITDA (without getting too technical, EBITDA is annual profit before interest and depreciation). Before the crash in 2008, multiples of eight and nine were common.

After 2014 prices (and hence perceived values) started rising fast, going from around 10 times to 15 or even 16 times by 2019. It is important to stress that this is not because the buyers were acquiring completely different companies. As you can see from the table 0n page 18, Clarion features twice, as does Emerald and the exhibition assets of Ascential. CloserStill appears three times – at 8.3X in 2012, 12X in 2015 and 16X in 2018. The 16 times estimated profits paid for CloserStill is the highest price paid for any company which can be analysed. It is also, strangely, the case that CloserStill was sold for both the lowest multiple in this period (2012) and the highest (2018).

In previous generations, the highest published multiple for a significant business was probably for Blenheim in 1996 – an estimated 13.4 times profits.

How do we calculate these multiples?

This is not as simple as it seems. I have included the deals in the last decade where sufficient information exists for a reasonable stab at the multiple to be made. In the case of publicly quoted companies like UBM, Reed or Informa this information is usually in the public domain. Most PE companies do tell their own investors what they are spending, but some of the assumptions are inevitably based on what is available and which may not be complete.

If we assume that all companies have a financial year end of 31 December, then there are at least three potential complications:

1) If the company is sold in January 2020, then it would seem relatively easy to use the 2019 EBITDA) as the basis for calculating a multiple (eg. if the EBITDA in 2019 was £10m and the price was £100m, then the multiple is 10 times). But well-run exhibition companies are a little odd. Assuming well run rebooks, then by January we know reasonably accurately what the profit for the next year (in this case 2020) will be. So the seller might well argue that the price should reflect the 2020 profits as much as the 2019 profits. This can confuse the multiple.

2) If the company is sold in July 2020 – do we take the profit as being last year’s (2019) or the current year (2020) or a mixture of the two?

3) Biennials are a particular problem in calculating a normalised EBITDA on which to base a bid for a company – particularly as some are massive, eg DSEi is now the largest show in the UK by revenue. Superficially, just taking one show’s profit and dividing by two solves the problem. But it doesn’t. Assume the biennial runs in the odd years – 2019, 2021. And assume the company is sold in 2020. Does the buyer take the 2019 Biennial show’s profit and divide by 2, or the 2021 Biennial show’s profit and divide that by two (the 2021 show may already be bigger than the 2019 show), or is there some subtle blend of the two?

Allowing for all that, it is still clearly the case that the price paid for trade show companies rose dramatically between 2010 and 2020.

So what might happen next?

I hate making predictions, particularly about the future. The answer is clearly: “I don’t know.” This is compounded by the pandemic. Certainly in the short term profits have fallen and this will (presumably) depress the value of exhibition assets.

But one can make the reverse argument quite aggressively. There was much talk of: “Will trade shows come back? Is the future digital?” But the evidence to date suggests very clearly that trade shows (where they have been able to run unencumbered) have come back very strongly indeed. If we can assume that by 2024 trade shows will be able to run pretty much as they were in 2019, then the argument reverses itself. The argument becomes: “Throw anything you like at trade shows – even international pandemics which bring travel and social interaction to a total halt for two years – they will survive it and come back strong. They are a truly resilient asset.”

But how does that affect value? Will multiples go higher? This is a tough one.

Would you have invested in stocks in January 2020?

Assume someone asked you the following question on 1 January 2020: “There is about to be an international pandemic which is going to close down the world for at least 18 months. Travel will fall by 90%. It is likely 10 million people will die worldwide. We have no vaccine with which to fight this virus. Economies will decline by 20% and government debt will rise to over 100% of GDP in all major economies. Would you now put your money into stocks and shares?”

Most of us would surely have answered: “No way.”

And what happened? The broad world market indices rose 46% in those two years – so £10,000 invested in stocks and shares on 1 January 2020 was worth £14,600 by 31 December 2021.

That is why I would not predict what happens next. On the positive side, PE is sitting on a wall of money and it has to be spent somewhere. The number of attractive assets is declining as the bigger groups acquire more of what is available. As Informa’s recent announcement to sell certain assets and invest some of the proceeds in events indicates, the signs are that trade shows are again seen as very appealing acquisitions.

The other side of the story

But there are negative stories as well, the most often quoted being Toys R Us. In 2004 the well known 69-year-old retailer was acquired for $6.6bn by two PE companies – Bain and KKR – and a property company, Vorando. But 80% was borrowed and Toys R Us had to pay much higher annual interest charges as a result.

In 2004 it had $2.2bn in cash, by 2017 that had shrunk to $301m. Its overall debt had skyrocketed to $5.2bn and it was paying between $425m and $517m in interest every year. The consequence was that the company did not have the funds to revamp its stores or compete aggressively with Walmart and Amazon. Interest charges were consuming 97% of its operating profit. In 2018 it announced it was closing 900 stores and 33,000 people lost their jobs.

It is usually retail where we hear the negative stories and the long slow decline of Debenhams was another example of funds paying themselves large dividends.

I need to stress there was nothing illegal or dishonest here.

Shareholders of any company are entitled to vote themselves dividends as long as the business has the wherewithal to pay them.

So how does private equity work with trade show companies?

I have been involved with nine PE deals involving exhibition companies. In none of those cases – nor in any other case that I know of – could PE be accused of a short-term approach nor of extracting funds from the business.

I cannot stress enough that in every case the approach has been to reinforce the business, leave a large percentage with the previous owners and staff (typically 20-30%) and then to invest in the company. This has typically been by funding acquisitions and investing heavily in systems. In the last 20 years this can be shown to have been very successful indeed.

If we take the most obvious examples on public record. Clarion had been valued at some £44m in the early 2000s. In 2008 it was valued at £120m, in 2015 at £215m and in 2017 at £600m and it would certainly now be valued at north of £1bn. CloserStill, founded in 2009, was valued at £25m in 2012, at £125m in 2015 and £340m in 2018.

It is worth mentioning that these numbers are not the price the company was bought for in cash. If a PE house buys 70% of the equity, then it obviously only pays 70% of the value. The prices which I quote are almost always from the public record. In the case of any PE deal, the PE companies themselves give their own investors details of the deals they do. Thus they tend to be largely transparent.

Clearly the companies quoted on the public markets have benefitted from these trends. The share price of UBM rose from £5.17 in 2013 to £10.77 in 2018, though some of the profit improvement was a result of acquisitions (I was a shareholder in both UBM and Informa).

In only one case to date has there been a material change in the management of the business, and that is in the rather unusual situation of Emerald in the USA. Onex, a Canadian PE firm, acquired Emerald and then chose to float it and we have seen an unusually dramatic decline in value – from $23 per share in 2017 to just $3.39 today.

Private equity and the trade show business

The reader might say that I am biased, having been intimately involved in Blenheim and CloserStill and a number of other PE deals such as Spearhead, Upper Street and Nineteen Events.

But the records of both Clarion and CloserStill do suggest strongly that the preparedness of PE to back managements and provide investment has been a major positive. Clarion – still run by Simon and Lisa as well as Russell – has grown from a value of £44m to (probably) more than £1bn in the past

20 years.

In less than 10 years CloserStill grew from literally nothing to £340m, via three PE deals. It is certainly not a matter of PE funding acquisitions – of the 50 shows CloserStill currently runs, 35 were launches.

In addition, both Earl’s Court Olympia and the NEC have been owned by PE.

It is very unlikely that many of our larger exhibition companies and venues could have grown the way they have, and employed the number of people they have, had they not had access to the phenomena of venture capital and PE. Nor would West London be the centre of the world’s trade show industry.

The counter-factual of “where would we be if that funding hadn’t existed?” is impossible to answer.

It is also now not very material PE and public funds is the world we now all live in, and the world which will largely determine how our business develops in the next decade and probably beyond.