Exhibition research specialists Explori published the findings of their 2018 Global Visitor Insights at the UFI Global Congress in St Petersburg last year. Produced in partnership with UFI, the Global Association of the Exhibition Industry, and supported by the Society of Independent Show Organisers (SISO), the report represents the biggest ever global study of trade show visitor experience. Explori Global Strategy Director and report author, Sophie Holt, outlines some of the key findings.

Overall, the view of trade shows among our visitors is positive and stable. When we look at the Explori Global Benchmarks, which contain visitor feedback on over 1,600 trade shows, key indicators of visitor experience such as Net Promoter Score (NPS) have been stable over the last three years, at +5 in 2016 and now +7 in 2018 for trade show visitors. This is reflected in the responses to the survey; most visitors report trade shows are performing about the same, if not getting a little better.

But is fatigue is setting in for some regions?

We can see that visitors in markets where the trade show industry is more developed, such as Europe and North America, are more likely than visitors in developing markets to say trade shows are getting worse: 27% of visitors in North America think trade shows are getting worse, compared to only 14% in the Middle East and Africa.

The most cited frustrations for visitors will be a familiar list to most organisers: seating, catering, parking and queuing.

However, visitors with these frustrations generally like trade shows, find them beneficial and plan to attend them again in future. When we look at respondents who dislike trade shows and do not find them beneficial, they tell us about very different frustrations.

Core drivers of visitor satisfaction

Visitors with negative views are much more concerned about their ability to meet the right exhibitors. This supports the insight from the Explori Global Benchmarks, where we can map how closely different visitor objectives correlate with overall satisfaction. Again, we see that exhibitors are key to visitors meeting their most important objectives of “sourcing new products” and “staying up to date with market trends”.

Twenty-nine show directors and senior marketers were interviewed to support the research. Many of them emphasised the importance of a seamless visitor experience and creating a ‘Wow-Factor’ for audiences through tactics such as ‘festivalisation’. Organisers may be in danger of under-valuing the core role of the exhibitor in driving visitor satisfaction.

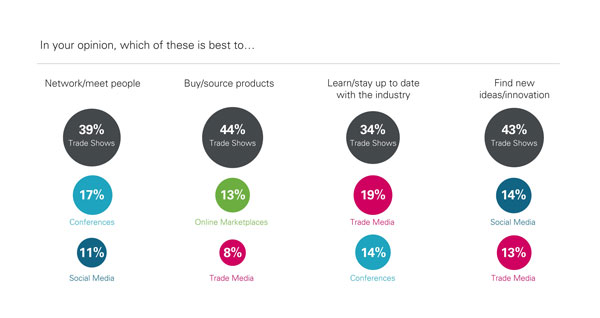

This study allowed us to understand visitors’ overall views of trade shows as a channel to meet their business objectives. Again, the results were positive; across a range of business objectives, trade shows were the preferred channel ahead of social media, online market places and trade publications.

While visitors are most likely to see trade shows as the best channel to achieve their goals, they do recognise and at times prefer alternative formats.

Shows that traditionally operate as buying forums are potentially at risk, and in fact 15% of visitors see online marketplaces as better ways to buy/source products, with this rising to 29% among under 24’s. Similarly, learning about the industry is facilitated by other channels such as trade media, conferences and social media, with only 34% who say trade shows are the best way to achieve this goal. Those aged under 34 and women of all age groups are more likely to prefer social media as a channel to find new ideas and innovation.

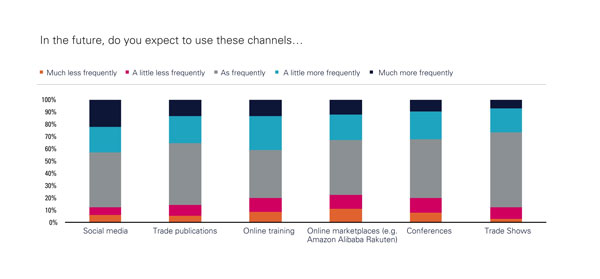

It is important to note that while survey respondents said they expect their trade show attendance to remain stable, they expect to increase their use of all other media channels, potentially putting more pressure on the trade show model. Many organisers, however, see this as an opportunity rather than a threat, as trade shows partner with other channels to attract visitors, or become content creators themselves. Organisers refer to a desire to create communities around their events and provide content 365 days a year. However, some express concern that to be successful at this, the structures and skill sets within their organisations will need to evolve beyond one designed to deliver a trade show over a period of a few days.

Many organisers, however, see this as an opportunity rather than a threat, as trade shows partner with other channels to attract visitors, or become content creators themselves. Organisers refer to a desire to create communities around their events and provide content 365 days a year. However, some express concern that to be successful at this, the structures and skill sets within their organisations will need to evolve beyond one designed to deliver a trade show over a period of a few days.

How can we make the most of this research?

The findings of the Global Visitor Insights project will be new insight for some, setting out the direction of travel for our industry as millennials fill more senior positions, and the use of technology becomes more ubiquitous. For others it will confirm with robust data the changes they are already seeing on their show floors. Either way, we hope it will spark discussion within show teams, venues and suppliers as to how they can stay relevant to changing visitor expectations.”

Explori’s recently released full report, giving more detail on trends such as festivalisation, use of technology and attitudes towards sustainability is available to UFI members via ufi.org/research. Non-members can contact Explori direct to receive a summary. Contact: s.holt@explori.com