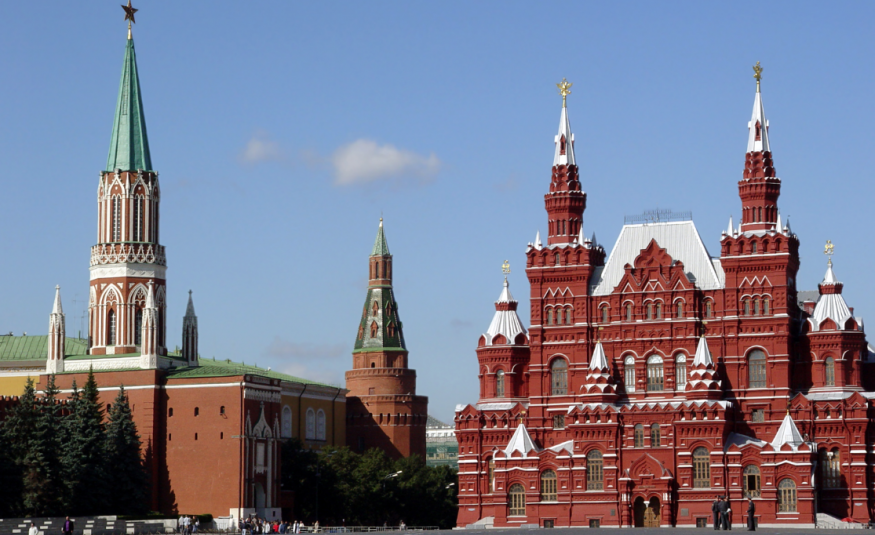

ITE Group has reported a solid performance this year in its preliminary results, despite a challenging trading environment in key markets Russia and Central Asia.

Russia sanctions and a weak rouble were among the factors cited that held back ITE’s performance. The global conference and exhibition organiser saw its full year profits drop by a quarter, as Western sanctions put pressure on the Russian market.

CEO of ITE Group Russell Taylor put a weak performance in Central Asian states down mainly to the weakness of the oil price and domestic currencies.

A 50 per cent drop in the value of the rouble against sterling accounted for most of the £6.5m foreign exchange loss suffered in the year, ITE’s financial statement noted, and a reduction in core business through adverse economic conditions accounted for a further £12.5m of shortfall against last year.

Taylor told EW that, despite a weak performance in Russia, he expects a pick-up in the country by around 2017. “Our focus now is on emerging markets, including China, South East Asia, Africa and India. The Russian economy is mainly driven by oil, and as exports suffered, so did trade overall.

“Offsetting this was a positive biennial contribution of £1.4m, and the benefit of newly acquired businesses, which had an incremental effect of £2.6m in the year after additional financing costs,” the company statement added.

Taylor went on to add that the group’s other regions, which now account for over 40 per cent of ITE’s business, were trading well.

“ITE has continued to diversify its portfolio and strengthen its industry verticals by acquiring leading events, establishing a better geographic balance between its historical Russian-CIS businesses and other leading emerging markets.”

On a like-for-like basis, volume sales fell by 14 per cent and revenues fell by 12 per cent.

The group also reported that its fiscal 2015 profit before tax declined to £31.5m from £41.5m last year. Earnings per share were 10.4 pence, down from 13.8 pence last year.

Over the past 12 months, ITE acquisitions have included 50.1 per cent of a portfolio of events including Africa Oil Week.

“ITE has established cornerstone businesses in three of the largest emerging markets of the future – China, India and Africa. The group operates a resilient business model, a flexible cost base and our strong market positions mean the group is well placed to benefit from any future improvement in the Russian economy,” Taylor added.

In other financial results news, The Daily Mail and General Trust (DMGT) announced preliminary full year figures that included a one per cent dip in revenues and underlying profit down 4%.

Adjusted profit before tax of £281m is down four per cent at the publisher and event organising group.

Analysts said good profit growth from dmg information and dmg events was more than offset by increased costs and challenging market conditions for the RMS (one) and Euromoney operations where underlying operating profit dropped 15 per cent.

DMGT oversaw a £100m share buy-back programme, while net debt increased by £99m to £702m.

Chief executive Martin Morgan described the results as “resilient” and stressed continued growth in earnings per share.

“The strength and diversity of the group's portfolio has enabled us to navigate challenging market conditions and take a long-term view by investing for future growth,” said Morgan.