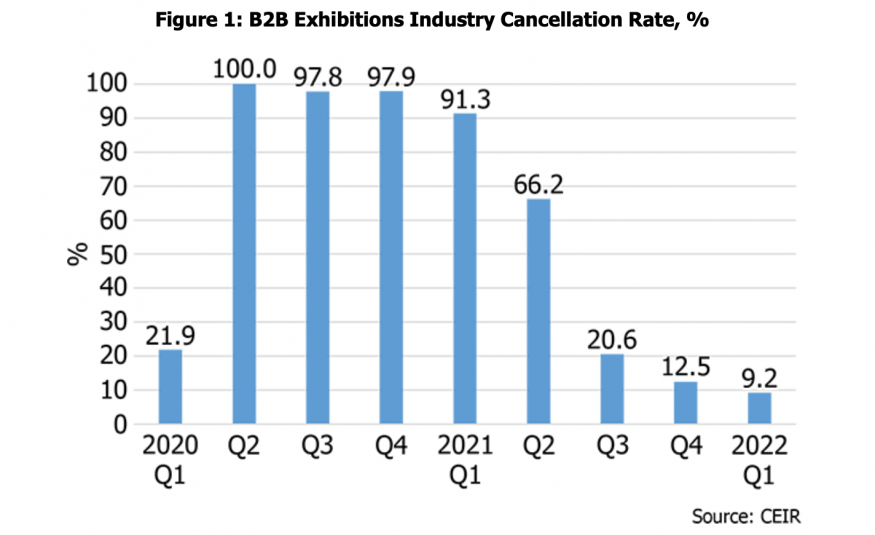

The Center for Exhibition Industry Research (CEIR) reports that the US business-to-business (B2B) exhibitions industry improved significantly in the first quarter of 2022 from the previous eight quarters.

Compared to 2021, cancellation rates for physical in-person events continues to drop with a cancellation rate of 9.2% in Q1 2022, compared to 91.3% in the first quarter of 2021, 66.2% in the second quarter, 20.6% in the third quarter and 12.5% in the fourth quarter. About 98% of exhibitions were cancelled during the second half of 2020.

The drop in cancellations and the improvement in completed events boosted the Q1 2022 Index result. However, as expected, the CEIR Total Index – a measure of overall exhibition performance – remains below 2019 levels, registering a decline of 37.9% compared to 2019. Still, this is a vast improvement compared to the four prior quarters: a decline of 94.0% from 2019 in Q1 2021, 75.6% from 2019 in Q2 2021, 50.6% from 2019 in Q3 2021 and 45.3% from 2019 in Q4 2021.

Of all the shows originally scheduled to be held in the first quarter, 1.6% were postponed, 8.3% cancelled and 90.1% completed as scheduled. Among cancelled events in Q1 2022, 50% instead offered digital events, down from 78.5% in Q4 2021.

Q1 2022 results speak to a continued, choppy and uneven recovery that is underway, though the direction is positive, with the industry slowly improving overall.

Among completed events, 15.3% have surpassed their pre-pandemic levels of the CEIR Total Index. Excluding cancelled events, the Total Index for completed events in Q1 2022 dropped by 31.5% from 2019, compared to a decline of 54.9% from 2019 in Q1 2021, 39.8% from 2019 in Q2 2021, 45.8% from 2019 in Q3 2021 and 40.5% from 2019 in Q4 2021.

Real Revenues suffered the largest fall of 34.2%, followed by Attendees with a decline of 32.9%. Exhibitors tumbled 30.1%. Net Square Feet (NSF) in Q1 was the metric that contracted the least, 29% from the first quarter of 2019.

“B2B exhibitions offer opportunities for buyers to find alternative reasonable-price supplies under the current elevated inflation environment and persistence of global supply chain challenges,” said CEIR economist Dr Allen Shaw, chief economist for Global Economic Consulting Associates, Inc. “The B2B exhibition cancellation rate should decline further and the performance of completed events will continue to improve.”

CEIR Omnichannel Study results indicate strong intent to return in 2022, particularly on the exhibitor side but with slightly softer intent to return among attendees. The core values of the B2B exhibition channel motivate a return to participating, as Cpvid-19 ebbs.

There continues to be pent-up demand for face-to-face engagement. The January 2022 Covid-19 Impact and Recovery survey results indicate the overwhelming percentage of organisers have plans to run their 2022 events, despite Covid-19 as a factor when the survey was fielded.

“Despite Omicron at the outset of 2022, our industry pressed on; many have held their events and have done so successfully and safely,” added CEIR CEO Cathy Breden. “While it will take time to get back to 2019 performance levels, we are on our way. With vaccine mandates and safety measures implemented at large gatherings, and with a majority of the population vaccinated, the recovery of B2B exhibitions should continue in 2022, unless a new variant causes a severe fifth wave of Covid-19 infections.”

Click here for information on how to purchase the complete 2022 CEIR Index Report as well as individual sector reports. The CEIR Index Report provides data on the US B2B exhibition industry across 14 key sectors. A deep dive discussion on the state of the industry will be discussed at the CEIR Predict Conference, 15-16 September 2022, at the MGM National Harbor.