From EW issue 2: Julien Schmetz, senior consultant at jwc, previews the all-new extended Global Industry Performance Review (GIPR) and shares some exclusive key insights

jwc’s Global Industry Performance Review (GIPR), based on the structure of Jochen Witt’s annual presentation at the UFI Congress, is more relevant than ever given the global pandemic. The format and content have been enhanced this year and the full report will be released at the end of April. It will consist of three parts and for each a webinar will be organised after publication, allowing discussion of the report alongside presentations of key insights by jwc experts.

Next to its traditional analysis of the top 40 exhibition company financials, global and regional market sizes, and the development of the most important countries, the new GIPR will give a comprehensive overview of Covid-19’s impact on the industry’s performance and an outlook into an uncertain future.

In a new, second section of GIPR, never-before published insights about the Chinese market will be revealed. It will provide extensive new perspectives on Chinese venues and market size, as well as insights into the structure and developments of the Chinese market.

The third section will deal with the evolution of business models in our industry, shifting away from the notion of pure hybrid events towards omnichannel models. This section gives an overview of digital transformation in our industry and Covid-19’s impact, including recent developments in digital offerings and trends that reinforce the need for a strong digital strategy. We present our approach to a seamless integration of digital and physical offerings, omnichannel business models, and give specific advice to organisers on what steps need to be taken to develop such business models for different shows.

The damage of the pandemic to our industry, compared region-by-region and to other sectors

Unsurprisingly, the impact of the global pandemic takes centre stage of the industry performance section. The report compares the exhibition industry’s performance with related sectors such as tourism and aviation, before and during the pandemic. The analysis underlines that hardly any other sector has been hit as hard as the global exhibition industry. In the US for instance, employment by convention and tradeshow organisers dropped 44% compared to February 2020 – no other travel-related sector has seen a greater decrease.

The report includes an overview of governmental aid to the overall economy, to comparable sectors, and to the exhibition industry.

Not every country has been equally affected by the crisis, as GIPR’s regional analysis demonstrates. The section includes the exhibition industry’s performance in all major regions, complemented with additional macroeconomic and region-specific analyses. For all regions, market sizes in terms of revenue and space is shown.

In many countries, the exact date of market re-openings remains to be determined. Moreover, the structural changes triggered by the Covid-19 outbreak reinforce the uncertainty with respect to the future growth of the industry. Mega-trends such as the greatly amplified importance of digital offerings or the grim long-term outlook for international business travel cast doubts whether international tradeshows will ever reach their pre-pandemic volumes in terms of net rented space. The report contains global and regional industry forecasts for the coming five years, based on a set of possible scenarios.

How the 40 biggest exhibition companies performed over the last decade – and in 2020

The previous decade has been a comfortable one for the industry: The top 40 companies grew on average 5.8% over the last decade, including acquisition effects. The growth has even accelerated in the three years before the pandemic, amounting to an average of 7.2%.

Most exhibition companies have also hit their commercial targets: Pure-play organisers have shown healthy profit margins, with the Top 8 averaging 26% of Adjusted-EBIT margins from 2010 to 2019. Most venue-owning companies were profitable, albeit less than pure-play organisers, and generated high economic impacts for their local economies from in-person events.

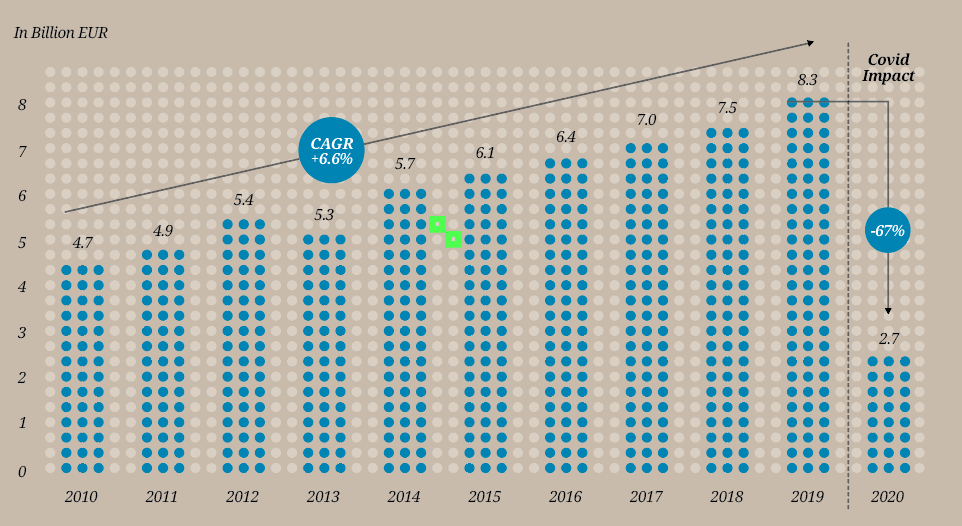

As Figure 1 suggests, the pandemic has completely disrupted this strong performance. While the top 10 companies have grown 6.6% over the past decade, their revenues have dropped by a staggering 67% in 2020, with decreases of almost 80% for some companies.

The report has comprehensive analysis of the financial development of the top 40 on the market, including profitability and market share over a 10-year period. Revenues are also shown by segment and by industry-vertical for selected companies.

The GIPR industry ranking again gives an overview of the Top 20 organisers by revenue, adjusted-EBIT and adjusted-EBIT margin. The pandemic has shaken up the ranking and for 2020, cost-cutting measurements following the pandemic are quantified. Deep insights on the drivers of financial performances are showcased, such as differences depending on the ownership type or benchmarks on personnel costs or depreciations.

Brand-new insights on the hottest market of the industry – China

For the first time, the GIPR includes a dedicated section on a focus country in each annual edition. This year’s focus is China, where the market has recovered quickest from the pandemic, underlining its role as the No.1 growth engine of the global economy and the exhibition industry.

The report provides new insights on various dimensions of the Chinese exhibition industry. It includes the development of key metrics over the past 10 years, the 10 most important organisers with their revenues and market shares, the biggest industry verticals and major shows per vertical, ownership structures, information on pricing and a view on China’s current venue capacities and venues under development.

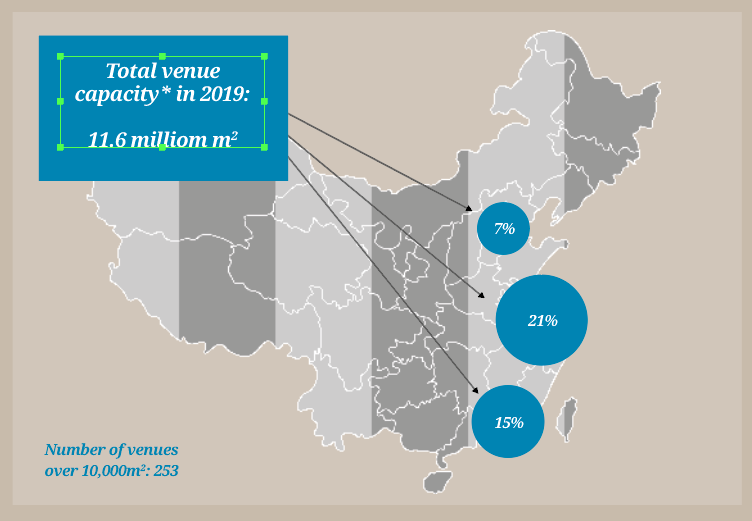

Figure 2 illustrates venue capacities in China’s three most important economic clusters: The Beijing-Tianjin-Hebei Circle (15 cities), The Yangtze River Delta (26 cities) and the Pearl River Delta (nine cities). The report goes further and shows capacities for all new-tier 1 cities, the cities in which the biggest growth opportunities lie. Across a total of 253 venues with a capacity of at least 10,000sqm, China’s total capacity amounts to more than 11.6 million sqm. 43% of the capacity is located in China’s three major economic areas.

Next to venue capacities, the regional section offers an unprecedented depth of information about the most important shows, industries and venues for each tier-1 city and the top 3 Circles.

Overview of digital offerings in our industry and Covid-19’s fundamental impact

In its last section, the new GIPR offers a detailed view on digital transformation in the exhibition industry: It looks back on the rush into virtual show formats and presents a model that proved successful in leveraging the synergies of digital and physical offerings in other face-to-face driven sectors – the omnichannel business model.

After presenting three drivers that support the proliferation of digital offerings in the exhibition industry, the report reviews their two main dimensions and goals: making physical tradeshows more comfortable and successful and extending a show’s value proposition by adding complementary offerings all year long.

Assessing the impact of the pandemic, the new GIPR proposes answers to questions such as why the industry has been so slow in adopting digital offerings before the pandemic and why the recent rush into virtual event formats has fundamentally changed customer expectations. GIPR demonstrates how virtual event platforms and event-technology service providers are trying to build end-to-end online and onsite solutions for different event formats and how the funding of virtual event platforms has exploded lately.

GIPR also provides an overview of big-tech players moving into the industry, what percentage of revenue from digital offerings exhibition companies are expecting over the coming years and how much they are planning to invest in digital offerings.

Shifting towards omnichannel business models to elevate a show’s value proposition

Other traditionally face-to-face driven industries have been affected by emerging digital business models earlier than the exhibition industry. Retail, financial services and real estate are adopting omnichannel business models, creating one consistent customer journey across complementary digital and physical touchpoints.

Omnichannel business models optimise the customer experience across all channels of customer interaction by leveraging synergies between the channels. Placing the customer instead of the product at its heart, the most important step is to understand customer needs and expectations and orient both online and physical offerings towards them.

The new GIPR looks at the lessons from the retail industry, including the disruption that online pure players like Amazon brought to the traditional face-to-face sector, the transformation of traditional purchasing journeys and the move towards multichannel models of traditional retailers. It will also show the shortcomings of multichannel models, the steady increase of e-commerce volumes and the emergence of omnichannel models, adopted by both online pure players who are moving onsite and onsite players who are moving online.

One key lesson from retail is that there is no one-size fits all omnichannel solution, as customer expectations depend on the overall value proposition of the brand: While Walmart’s omnichannel offering is centered around a cheap and speedy purchasing journey, Nike’s offering emphasises the lifestyle aspect of the brand, with sport-related content online and offline stores that feel like high-end gyms.

We are confident that omnichannel integration is the way forward for organisers who want to elevate their value proposition and respond to risen customer expectations following the Covid-19 outbreak. Our overall omnichannel concept for the exhibition industry, the result of years of research, is introduced in the report. Just as for retailers, omnichannel models must consistently reflect the value proposition of the event: Both the online and offline offerings need to be aligned to the character of the show (e.g., is it a transactional tradeshow or conference-driven show?), the location of the show, as well as the underlying customer needs dependent on the industry vertical the show serves.

The customer experience needs to be reviewed end-to-end: All interactions, communication and transactions, so-called touchpoints, need to support the overall value proposition and be integrated into one consistent customer journey. The ultimate goal is to keep the customer engaged in a continuous manner, so that they can satisfy their needs whenever and wherever they want.

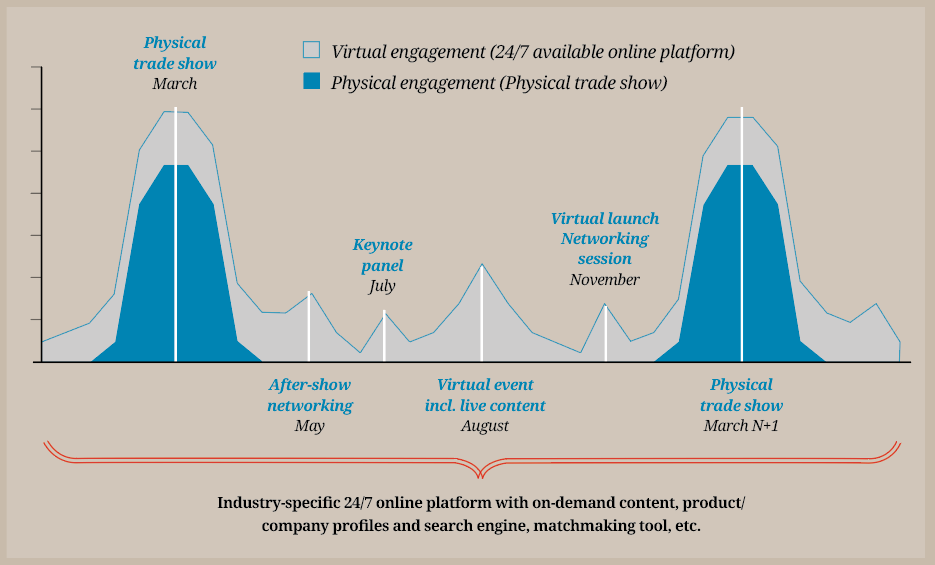

Figure 3 illustrates such continuous engagement of show participants with the community the respective show serves.

Omnichannel models in no way replace the physical show but use it as a key differentiator from online-only offerings in creating the strongest possible customer engagement. Hybrid and virtual show concepts that we currently see fall short here: Most are trying to transfer the interaction “as it would be face-to-face” to the online space. But online spaces have a hard time to create the mental activation in a way tradeshows do, places that trigger emotions and physical activation through our senses. Once physical events return, the added value of virtual or hybrid shows that are mainly inspired by the physical experience will be very limited.

Finally, the GIPR includes hands-on recommendations on what steps need to be taken when undertaking an omnichannel transformation and what major requirements need to be considered. During the webinars scheduled to take place after the report’s release, buyers of the GIPR have the exclusive opportunity to attend presentations of the GIPR and access more insights and actively take part in discussions with jwc experts.