In this article, Sebastian Witt, senior consultant at jwc, gives us an exclusive preview of the all-new GIPR and shares some first key insights with us.

The Global Industry Performance Review by jwc has established itself as a key knowledge source for experts and stakeholders of the industry. Following the success of the 2021 published report, this year’s report has once again been extended to provide readers with additional insights. The written report will be available on 15 December 2023. For all purchasers of the report, jwc will provide a Q&A session to have questions regarding our report and its analysis answered by our industry experts.

As in the previous years, the first section of the GIPR will take a closer look at global economic developments, forecasts and trends impacting economic growth around the world. The second and third chapters examine the global and key regional exhibition markets and take a closer look at the performance of the Top 40 companies within our industry.

After the strong interest in the last edition’s report on China, this year’s GIPR will provide an updated version and include two additional focus areas, namely India and the GCC countries.

In a further section the report will provide a broad overview of how to adopt a new business approach around value-based offerings. This approach parts paths with ‘business as usual’ and offers readers hands-on advice on how to increase profitability, customer satisfaction and retention in the long-term.

Finally, the report will focus on venues and take a closer look at global venue supply, venue qualities and provide strategic considerations around venue planning and performance management.

The road to recovery – on our way but not quite there yet…

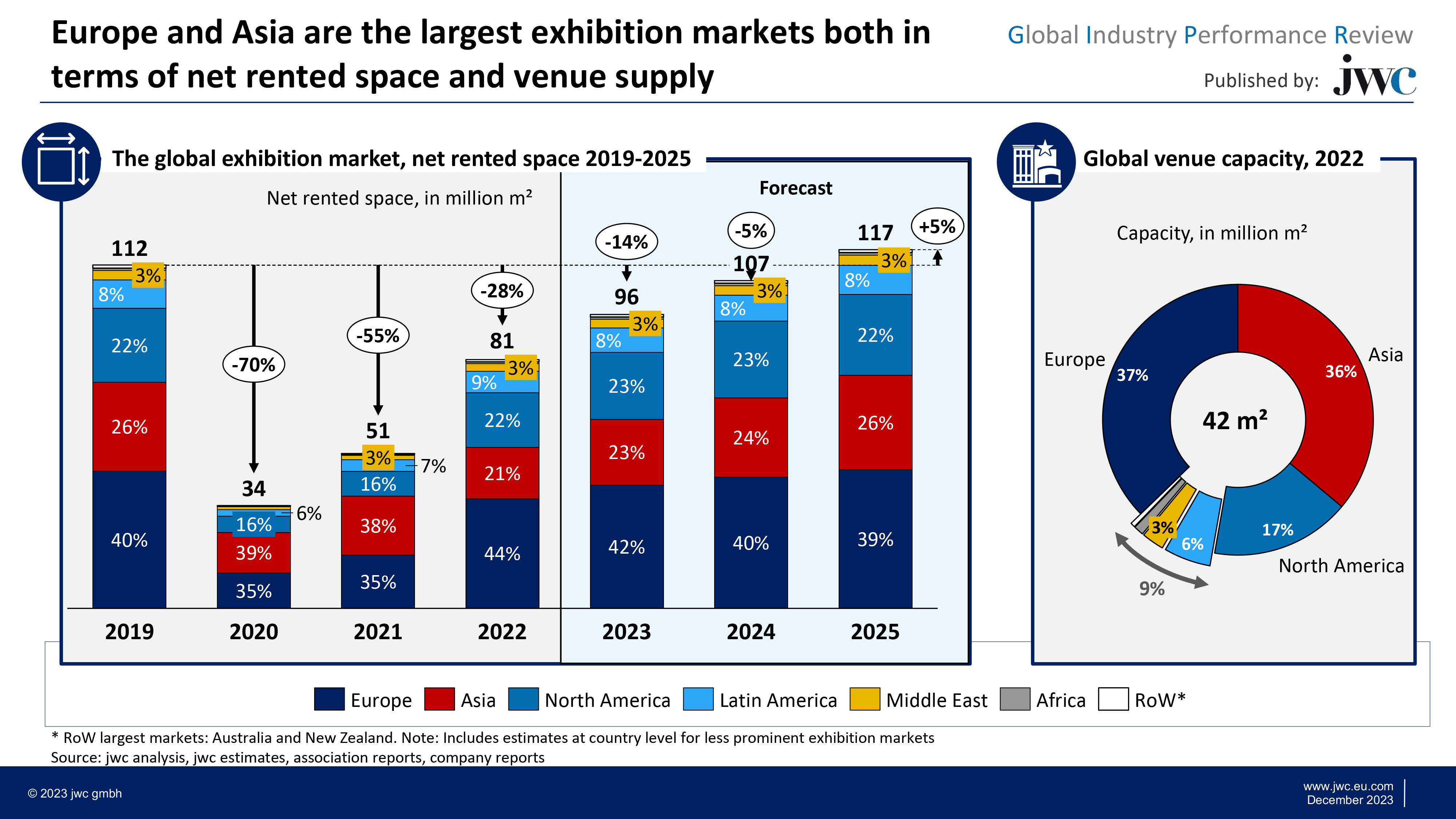

After providing context about the global macroeconomic situation and examining related sectors, such as the tourism and aviation industry, this report takes a closer look at how the exhibition industry has performed globally and provides profiling of the most relevant geographic markets for our industry, complemented with relevant KPIs and additional macroeconomic and region-specific analysis and forecasts. For all regions, current and forecasted market sizes in revenue and space, as well as the development of venue capacity are presented.

As shown in Figure 1, in 2020, the year hardest hit by Covid, the exhibition industry shrank by about 70% in terms of net rented space. Since then, our industry has shown impressive resilience. As of this year, we estimate that our industry is only approximately 15% below pre-Covid levels. Looking forward, we expect that our industry will reach pre-Covid levels in terms of net rented space at the latest by 2025.

How the 40 biggest exhibition companies performed over the last decade

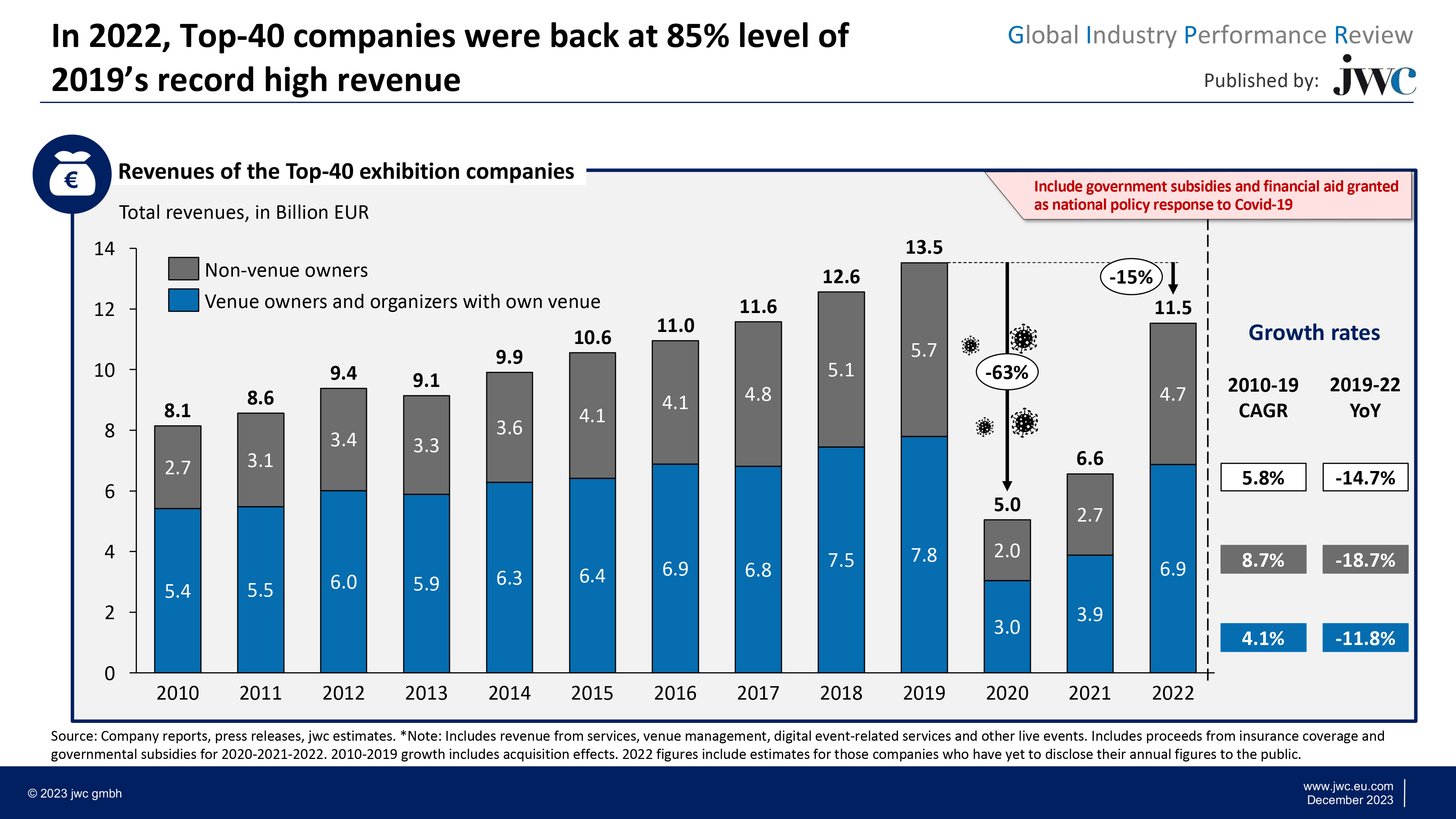

The report contains the most comprehensive analysis regarding the financial and operational performance of the top 40 largest companies in our industry. Revenues are dissected by segment and by regional source of revenue, for selected companies. Additionally, we link operational insights to financial results, taking into account metrics such as net rented space and exhibitor and visitor numbers.

The findings from the report suggest that from 2010 to 2019, the growth of the top 40 exhibition companies outpaced global GDP growth and even the growth rates of most of the S&P 500 companies. During this time, the collective annual growth rate for these companies averaged 5.8%. The non-venue owning organisers experienced a more robust growth rate of 8.7%, while venue-owning or managing companies saw a more modest increase of 4.1%.

However, the situation flipped during the pandemic. This shift can largely be attributed to venues adapting to alternative revenue streams, such as serving as vaccination centres or shelters, coupled with their reliance on state subsidies during the pandemic period.

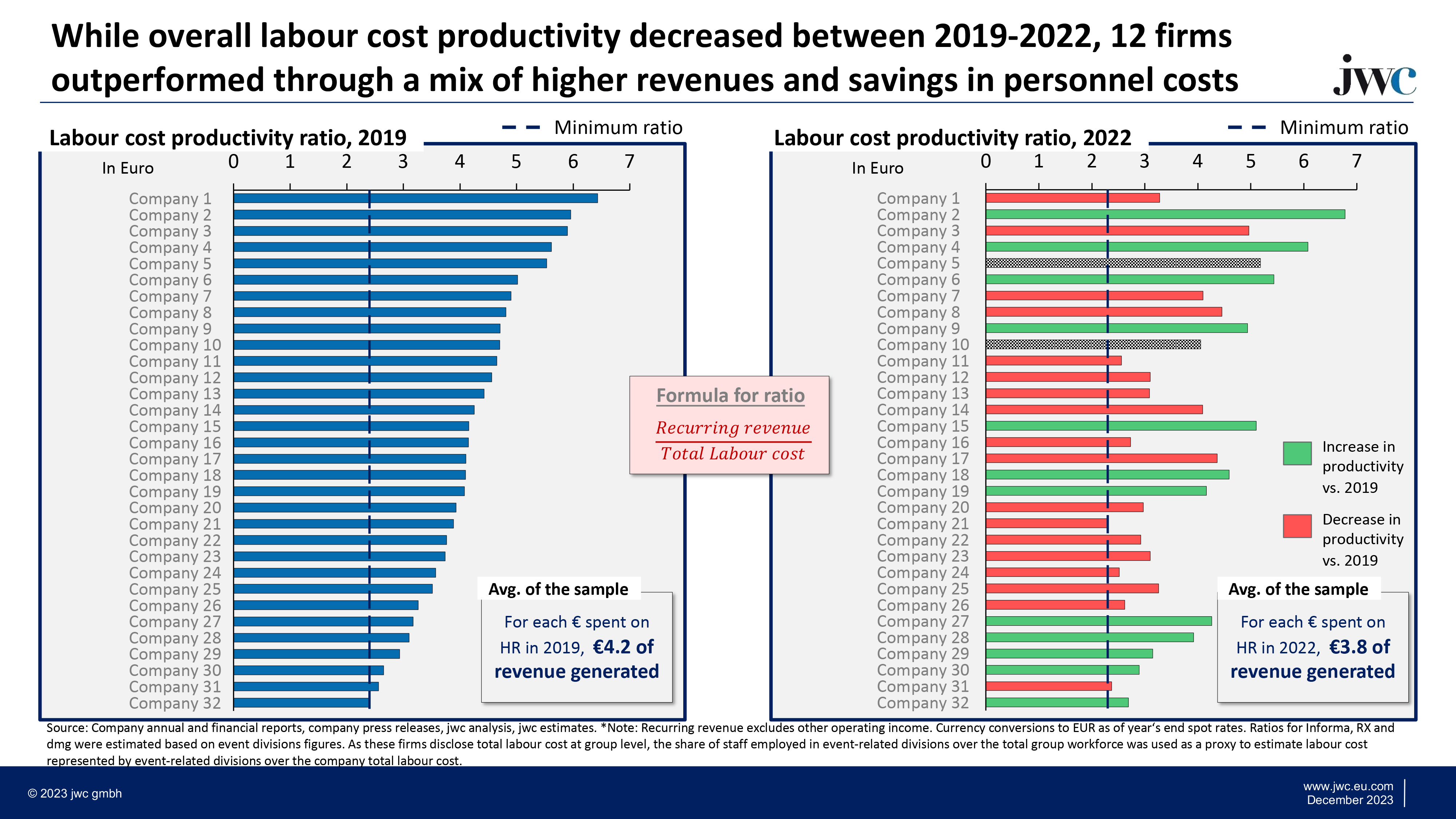

Looking more deeply into the top 40 performance, the report takes a detailed look at employment trends. The figure below depicts the productivity level of HR costs through select organisations of the top 40 group. The productivity score is determined as a ratio of recurring revenue earned per euro spent on HR. The figures suggest that the productivity of HR costs is distributed unevenly across the sample group, with some organisations earning twice as much per euro spent on HR than others. Within the report, explanations to these findings and more will be provided.

Regional deep-dives

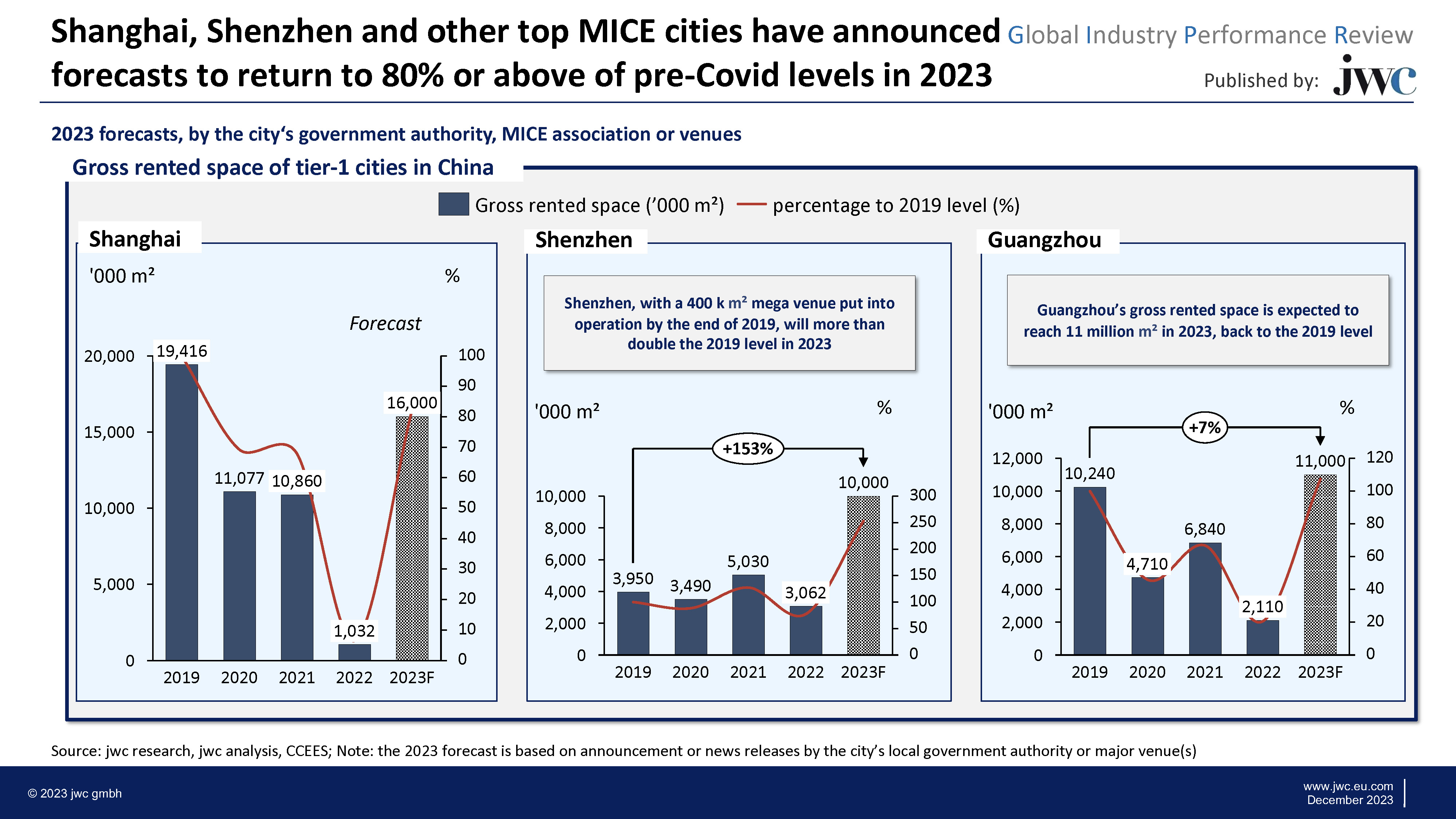

Following the success of the previous report’s special focus on the Chinese exhibition market, we have extended this special section with two new chapters now including both India and the GCC, in addition to China. Our research provides new insights about different dimensions of these exhibition markets: we analysed the development of key metrics over recent years, the most important organisers, the biggest industry verticals and the major shows per vertical, ownership structures and provide an overview of the respective venue capacities and venues under development:

Looking at China, the industry has regained momentum: Shenzhen World’s net rented space is set to more than double compared to 2019, Guangzhou is bouncing back to pre-crisis levels, and Shanghai's rented space in the first three quarters of 2023 has nearly matched 90% of its 2019 levels. On the other hand, the second tier and third tier cities in China are estimated to recover to 70%-80% of the pre-crisis level in 2023.

Adopting value-based business models

A newly-added special chapter presents and discusses the main dimensions that drive customer experience and satisfaction. From event formats, marketing activities to pricing and technology and digital, this chapter describes, how to expand the current value proposition and increase profit and customer satisfaction simultaneously.

Venues matter

In the final section of this year’s GIPR, we dive deep into the subject of venues. To begin with we will provide an analysis on global venue supply and will assess what regions have overcapacities and in what regions infrastructure is not yet developed to the required needs.

The report will then delve into the topic of venue quality, breaking down the factors that define and drive high-quality venues. We will offer an overview of major venues worldwide and apply a structured method to evaluate the quality of these venues.

Finally, the report will initiate a conversation about the operational strategies of venues, examining the revenue models of various organisations and exploring the strategic reasoning behind these structures.

If you are interested in finding out more about this year’s Global Industry Performance Review (GIPR), please see https://bit.ly/GIPR2023 or contact Sebastian Witt under switt@jwc.eu.com