Steve Monnington reviews the deals of 2022

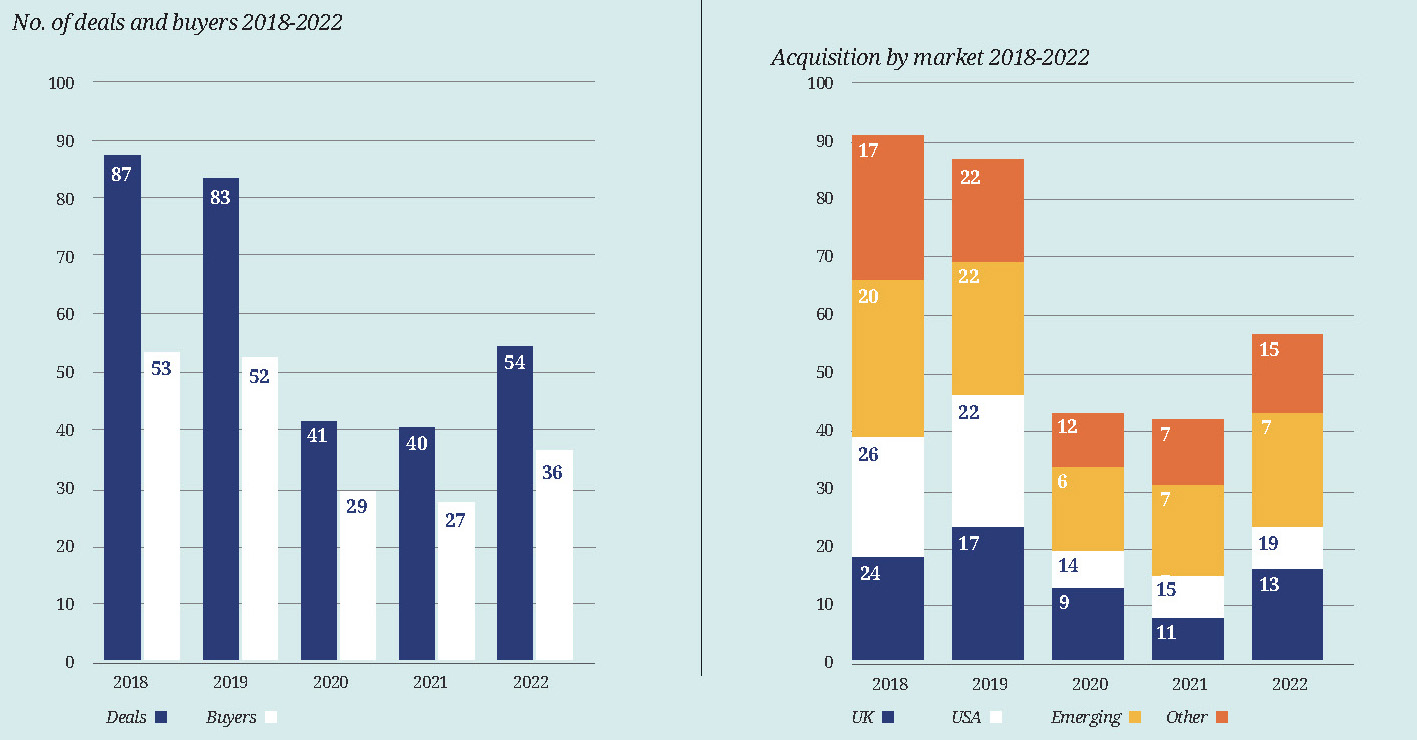

In the normal pre-pandemic years of 2018 and 2019 there were over 80 reported exhibition transactions with over 50 buyers. As I reported at the end of 2020 and 2021, Covid resulted in a halving of the normal M&A activity.

2022, with 54 transactions from 36 different buyers, represented the first post-Covid year but activity was still well below historic levels. This was due to a combination of almost no deals in China, low activity across South East Asia and the need for potential sellers to get back to at least 2019 levels of profitability before going to market. The US and UK continue to lead the way with 32 of the 54 transactions.

One notable feature of 2022 was the lack of M&A activity from many of the larger organisers – Informa, Reed, Clarion, dmg, Tarsus and Hyve managed just five transactions between them. Instead, it was left to Marketplace Events (5), Arc Group (4), IEG - Italian Exhibition Group (4) and Nineteen Group (3) to drive transaction activity. Three of these buyers (IEG being the exception) are Private Equity owned and Arc and Nineteen are both in the early stages of their first PE investment cycle.

Highlights in 2022 were:

- The acquisition of Euromoney Institutional Investor by Private Equity Investors Astorg and Epiris for £1.66bn (US$2.05bn). Astorg is to take control of the Fastmarkets division, which provides price data, news and market analysis for markets including agriculture, energy, and metals and mining. The remainder of the business – mainly the asset management and financial and professional services divisions – will be under the control of Epiris.

- The acquisition of Industry Dive by Informa for $389m adding Industry Dive’s audience development expertise, B2B digital marketing capabilities and 27 specialist business publications to Informa’s existing portfolio of specialist B2B brands.

- The acceleration of acquisition activity by Arc Group which, with HighQuest (a series of agriculture investment conferences in New York, Tokyo and London for investors, fund and farmland managers and agribusiness executives) and LRP Media (HR Technology and Education Technology), created a USA leg to the business.

- The return to the exhibition sector of Stephen Brooks with the formation of Market Dynamic Media (MDM) a private PE fund financed by his own holding company with Clarion’s Simon Kimble as chairman. Their first acquisition was DCD International – organiser of Data Centre Dynamics.

- The continuing disposal of historic assets by Hyve with their Ukraine and Turkey businesses sold as well as their 50% share of Debindo in Indonesia.

Strong M&A activity at the start of 2023

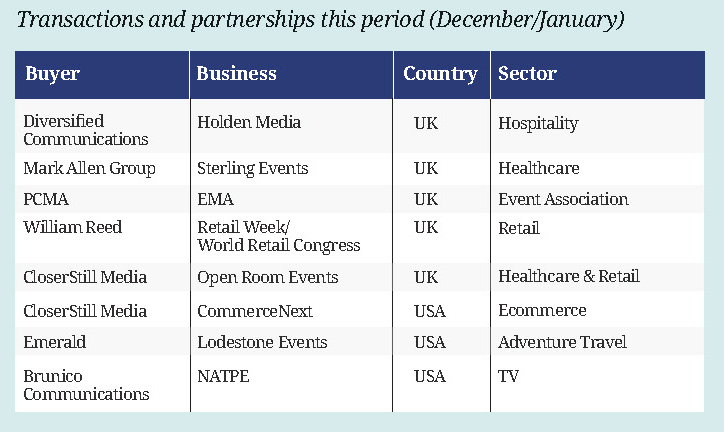

Although the five deals announced in the first two weeks of 2023 would have been negotiated in 2022, it shows that the uptick seen in 2022 is likely to continue this year.

2003 has started well for CloserStill Media with the announcement of two acquisitions. The first is a majority stake in Open Room Events, a business founded in 2004 by Fiona Horan and Emma Faure, both Blenheim Exhibitions UK alumni from the 1990’s who will continue with the business. Open Room delivers one-to-one events around the world linking C-level end-users with suppliers in the dental, pharmacy, eye care and retail sectors. The three healthcare sectors mirror a core part of CloserStill’s portfolio and allows them to deepen contacts in those sectors around the world.

The retail sector, which focuses on service stations under the ReFuel Forum brand brings a new sector to CloserStill. The interest in the one-to-one format follows their acquisition of the Influence Group (invite-only forums, one-to-one meetings and virtual roundtables) in 2021.

The second acquisition is also a majority stake, this time in CommerceNext a US organiser of ecommerce conferences and events including The ecommerce Growth Show, as well as webinars, executives dinners, curated networking events and industry research.

CommerceNext was founded in 2017 by Scott Silverman, Veronika Sonsev and Allan Dick who will all continue with the business.

CloserStill’s involvement in the e-commerce sector was seen with the acquisition of eCommerce Expo in 2017 which, along with Technology for Marketing, was considered non-core by UBM’s UK division. The eCommerce Expo was originally launched by Justin Opie and Graeme Howe who partnered with CloserStill to develop the business which has subsequently seen the ecommerce portfolio expand into Spain and Singapore.

US-based exhibition organiser Emerald has made its first foray into consumer shows (now a formal part of their strategy) with the acquisition of Lodestone Events, producers of the Overland Expo series of vehicle-based, adventure travel consumer shows. Emerald already has a position in outdoor recreation through its Outdoor Retailer wholesale trade show and has launched the Outdoor Adventure X show, a new consumer lifestyle event for the outdoor recreation enthusiast which has been developed in conjunction with Lodestone and will now be overseen by them.

William Reed made two acquisitions in 2022 (London Coffee Festival and Rethink) and has now acquired Retail Week and World Retail Congress from Ascential to add to their retail and manufacturing portfolio which includes The Grocer, Convenience Store, Forecourt Trader, British Baker and Food Manufacture. This is an interesting albeit small non-core divestment by Ascential which raises questions as to whether Money 2020 might be sold next.

A victim of the pandemic was the National Association of Television Programming Executives (NATPE) which filed for Chapter 11 bankruptcy towards the end of 2022. Brunico Communications of Canada, organiser of the Realscreen Summit, Kidscreen Summit and Banff World Media Festival, has acquired the assets of four international TV content markets and events (NATPE Global, NATPE Budapest, NATPE Streaming+ and the Brandon Tartikoff Legacy Awards). The business cost them just under $1.2m, $150k in cash and the taking on of $1.05m in outstanding liabilities. It is understood that both RX France and Questex also bid for the business.