Mark Brewster, Explori's CEO, on the emerging Middle Eastern opportunities

Explori presented an industry overview to members at the recent UFI networking event in Dubai at which I gave an overview of trends in exhibitor behaviour compared to the European expo market.

The Middle East and Africa (MEA) region contains a far higher proportion of events in launch and early maturity phases when compared to Europe. This is indicative of the MEA market being relatively new when compared to arguably the most mature exhibition market in the world.

It is an attractive launch market for both international and local organisers.

Estimates of growth in the region vary, but at the conservative end at around seven per cent, they far exceed growth in the European market which has been flat for several decades in terms of overall number of shows in operation.

With increased infrastructure, high quality new venues and accommodation and territories that had previously been inaccessible to overseas organisers now opening up, rates of growth will continue to increase.

As the MEA market matures and becomes more competitive, conditions for operators will change. From Explori’s analysis, we believe the European market can provide insight for MEA organisers as to how they might anticipate their market may change over the coming years and help them to make informed decisions as to how they might best respond to these challenges.

Whilst visitor satisfaction is on par with Europe, exhibitor satisfaction is much lower in MEA, with almost half of all exhibitors expressing low levels of satisfaction with events they support.

However lack of competition means that even when dissatisfied with an event, MEA exhibitors are still likely to continue to exhibit. The impact of low satisfaction levels can be seen in willingness to recommend; MEA exhibitors are much less likely to recommend events to their colleagues than those in Europe.

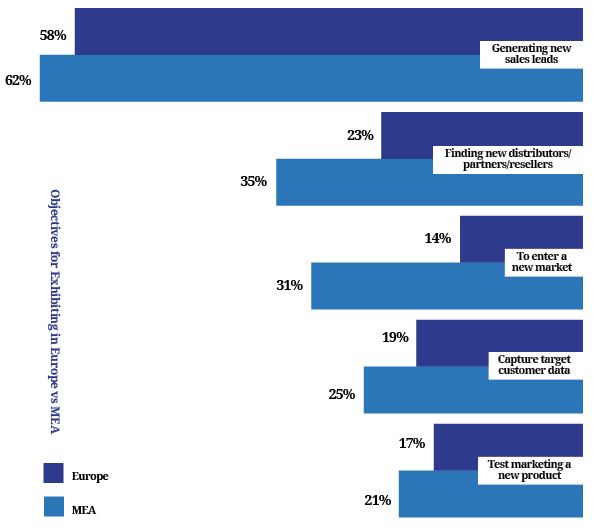

Objectives of exhibiting

Looking at reasons for exhibiting we can see that MEA exhibitors put more focus on generating sales leads over more general awareness.

Many more exhibitors at MEA events have the objective of entering a new market and creating the networks to enable them to do this. Exhibitors at European events place more emphasis on maintaining their current position and servicing their existing customers.

It is possible that some organisers, especially those who traditionally operate in European markets, have yet to recognise or effectively address this difference in exhibiting objectives and have not tailored their events accordingly.

A typical ‘hostage’ situation

When exhibitors are grouped using the loyalty vs satisfaction matrix, once again MEA is showing a larger proportion of Hostages than Europe. 17.5 per cent of exhibitors are not very satisfied with their experience at the events at which they exhibit, but they remain loyal to them, possibly because of the current lack of alternatives.

This is a typical ‘hostage’ situation. Many exhibitors are returning to events in the region, not because they successfully meet their business objectives, but because they don’t perceive there to be any alternatives available. These hostage exhibitors would be easily lured away by a competitor event, especially if it was more closely tailored to their needs.

Summary

With high advocacy and loyalty, the events market in MEA is currently very buoyant. But organisers could be facing tougher times in the near future. As new events launch and existing events mature, competition for attention and business will increase. Exhibitors who are currently loyal hostages will have new events to choose from and may be able to take a more mercenary view of the events they support. Loyalty will decrease as will satisfaction (we typically see in Europe, the greater the number of events an organisation supports, the less likely they are to be satisfied with their experience – they have more to compare against and higher expectations)

Exhibitor satisfaction is already at lower levels than in Europe, so as choice increases it can be anticipated that loyalty and advocacy will decrease to levels seen in Europe, if not lower. This will require organisers to put more effort and investment into securing each stand sale. Revenues and margins will decrease and any price rises will be contentious.

There are significant opportunities for organisers who can truly understand the drivers of satisfaction and loyalty amongst their attendees and exhibitors and invest in designing events that effectively deliver on these objectives.

Explori, the official research partner of UFI, has prepared this analysis using their dataset drawn from over 1.3 million exhibition survey responses globally, with over 1000 shows and expos contributing data. This regional comparison comprises anonymised data from 112 tradeshows in the MEA region and 500 tradeshows in Europe.