Assessing the impacts and predicting the future of the global exhibitions market has never been more difficult. For the latest annual Globex report released by AMR International, the analysis includes a full assessment of the global markets and an outlook to 2022. To better understand the challenges facing organisers, EW interviewed Globex editor Carole Boletti.

What has been the direct impact of Covid-19 on the global exhibitions market?

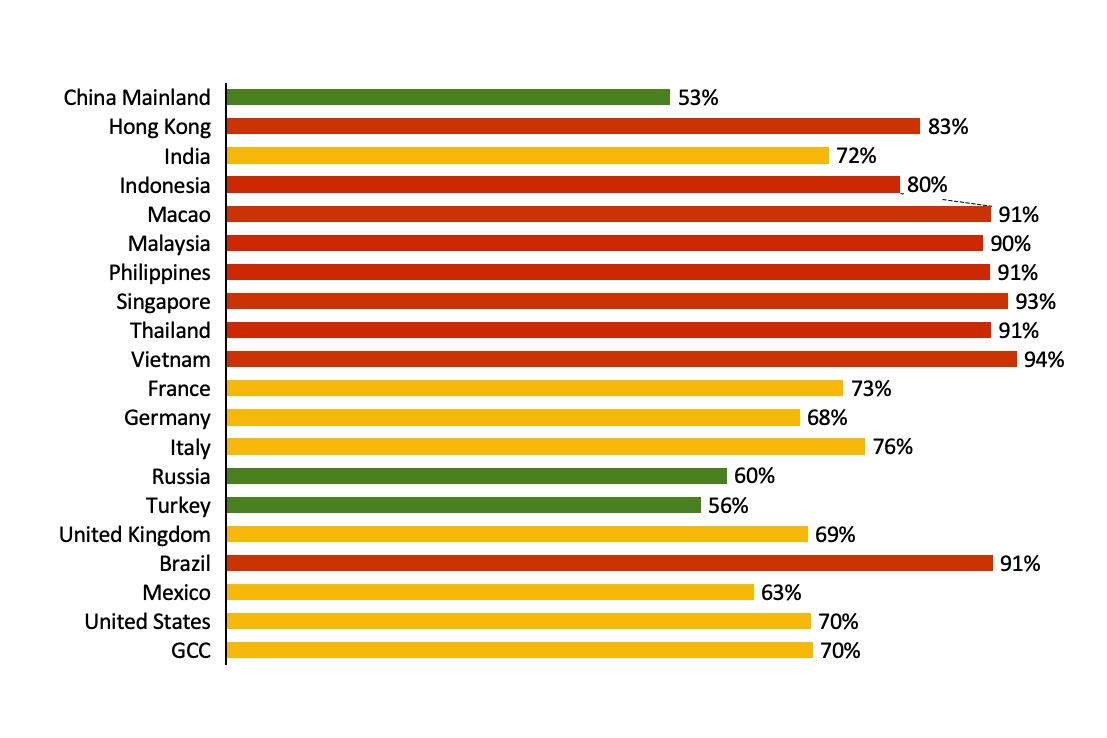

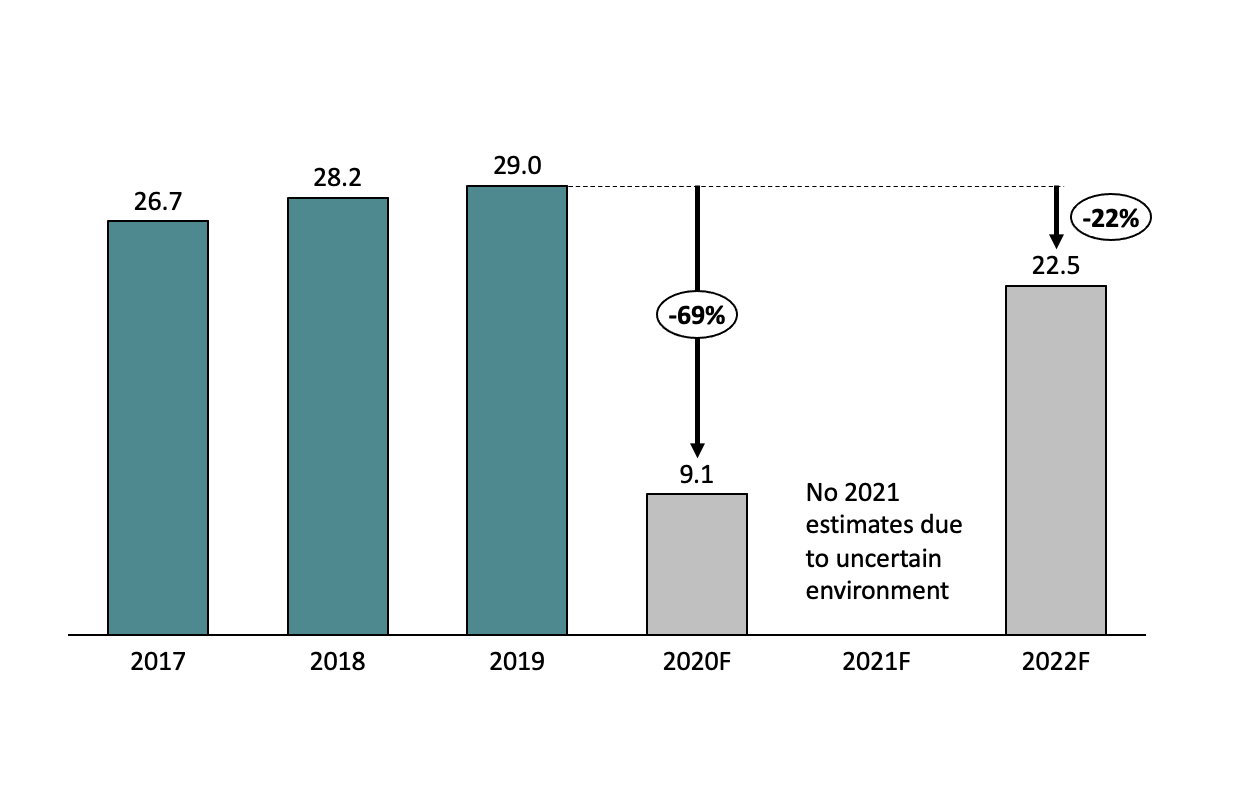

Without question, this year will see the sharpest drop in exhibition market value ever registered. Organisers around the world have been forced to cancel and reschedule a large proportion of their portfolios, leading to a considerable reduction in revenue. As a result, we expect the global market size in 2020 will contract by 69% from 2019 levels. There are quite strong country variations and our full report goes into the details behind this.

Estimated decline in market size in 2020 vs. 2019:

For organisers, 2020 has been a year of major upheaval. On the one hand, most have resorted to far reaching cost management programmes in response to greatly reduced revenues. On the other hand, many have moved their brands online to provide a digital platform for customer engagement. In some instances, these virtual events have been a source of revenue recapture, but in general are more viewed as a strategically important means of ‘occupying the space’ and remaining relevant in the eyes of their customers. We think that for the most forward-looking organisers, Covid will have prompted a major rethink of how they create value for their served communities.

It is worth remembering, however, that although a record year by absolute size (the market reaching US$29bn in 2019,) total market growth slowed to 2.8% last year compared to the 5.6% growth recorded in 2018. The reduced growth rate reflected a broader slowdown due to a reduction in manufacturing activity and heightened trade tensions between the US and China.

In addition, 2019 saw the most elections held in a year across G20 countries for over 50 years, which caused a level of political uncertainty. To a lesser extent, 2019 was also a slower year due to weaker biennial sales in certain mature markets (e.g. Germany, Italy)

Explain the challenge of forecasting for 2021? Can any assumptions be made at this stage?

The 2021 performance of exhibition markets will ultimately depend on the severity of future Covid waves, the effectiveness of vaccination campaigns and how regulation on gatherings will evolve. The unpredictable nature of all these determining factors makes a quantitative assessment of the exhibition market for 2021 nigh on impossible. That being said, we will be issuing live market size updates for our Globex readers in Autumn and in Spring 2021, as the market is changing so rapidly.

As the Covid crisis continues it becomes ever more apparent that 2021 will also see depressed revenue, with widespread cancellations and postponements already announced for H1. This is likely to place an even greater strain on those organisers banking on the return of F2F to solve their problems and not thinking about developing digital revenue streams.

What are the priorities for 2021? What must organisers now do if they are to survive the next 12 months?

As we approach the end of the year, it becomes increasingly clear that 2021 will look much more like this one – or at least more than we had previously hoped it would.

The disruptive and everlasting consequences of the pandemic on the exhibitions market will continue to accelerate the focus of organisers towards greater digital integration. An important priority for organisers across all markets will therefore be to further invest in digital solutions – a course of action many had initiated with the first wave of Covid cases (or even before it all started for the most progressive among them).

Already in Q2-Q3 2020, restrictions on mass gatherings promoted digital channels as the sole means for organisers to provide a platform for their customers to interact, to serve their communities and to support their brand value. As a result, 2020 has seen a surge in digital experimentation (e.g. hybridisation, online matchmaking, webinars, virtual sponsorship), with major examples including Gamescom in Germany, Festival of Licensing in the UK, and the Canton Fair in China.

When the world eventually reopens and physical events return, AMR anticipates that the acceleration of digital adoption and increased revenue associated with organisers’ expected new digital propositions will continue. 2021 will certainly not be a deviation from that trajectory.

Looking ahead a bit further, to 2022, we expect the market globally will recover to 78% of its 2019 size. Recovery rates will vary by country and will depend on many factors, such as the vitality of the underlying economy and international participation at events.

China is expected to rebound most positively, reaching 86% of its relative 2019 size. This is primarily due to the low international exposure of its events (c.90% of exhibition space is taken by domestic exhibitors) and the relative resilience of the underlying served end-sectors.

Brazil also has favourable geographic and sector exposure, but recovery is likely to be frustrated by a sluggish underlying GDP.

In other markets, AMR anticipates a stronger recovery as negative conditions in one area are offset by positive conditions elsewhere. For example, the drawback of Germany’s high dependence on international participants is expected to be offset by moderate exposure to ‘weaker’ sectors, the strength of the underlying economy, and the fact that 2022 will benefit from ‘even year’ favourable market conditions due to the market’s biennial characteristics.

Conversely, those markets that report a high level of international participants and a strong sector exposure are among those with the slowest recovery relative to their 2019 size. For example, the Gulf Co-operation Council countries serve a large international catchment area and has moderate to poor sector resilience. As a result, the GCC is forecast to grow back to 58% of its 2019 size by 2022.

In five years’ time how do you think the exhibitions market will have evolved?

We believe Covid will have a lasting impact in instigating a bifurcation of the exhibition industry between those organisers that remain mainly focused on episodic physical events and those that become 365 value creators. In association with the latter category, AMR – in collaboration with some of the industry’s major players – is developing a new vision for organisers.

Finally, these disruptive times can also be the opportunity for re-evaluating the place and role of exhibitions (and of their organisers) in the broader context of society. Major societal topics such as sustainability, ESG or diversity are likely to take on a new urgency as a new generation of leaders matures.

For more information about Globex 2020 visit: amrinternational.com/globex2020