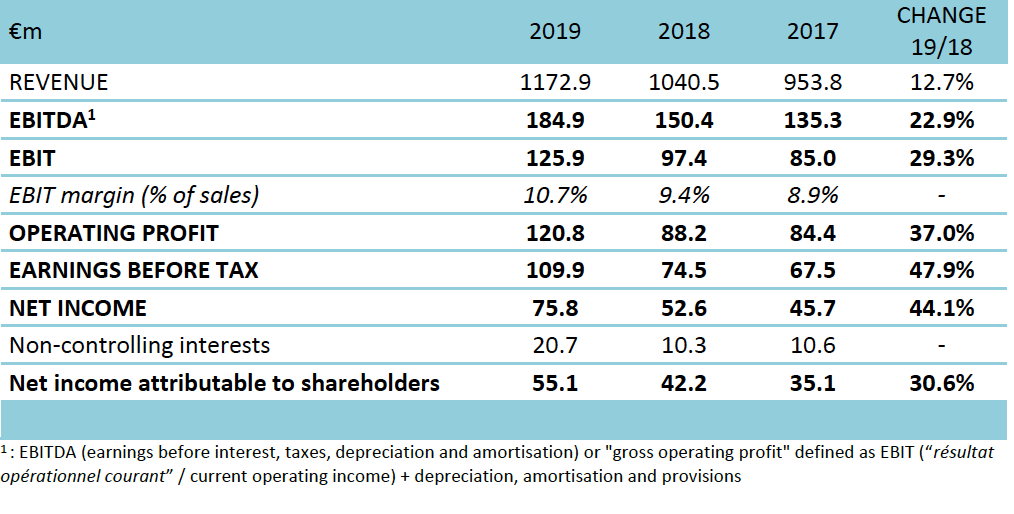

There are strong exhibition division growth figures from international organiser and venue group GL events, which announced, 4 March, that its Board of Directors had approved the annual audited financial statements for the fiscal year ended 31 December 2019.

Olivier Ginon, GL events Group’s Chairman commented: “GL events had an outstanding year in 2019 driven by the excellent performances of its three businesses. Our profitability has improved significantly both for our historical operations but also as a result of the accretive contributions of companies acquired in the period. This positive dynamic in terms of profitability is also driven by our CSR strategy and sustainable engagements that the Group intends accelerate.”

Olivier Ginon, GL events Group’s Chairman commented: “GL events had an outstanding year in 2019 driven by the excellent performances of its three businesses. Our profitability has improved significantly both for our historical operations but also as a result of the accretive contributions of companies acquired in the period. This positive dynamic in terms of profitability is also driven by our CSR strategy and sustainable engagements that the Group intends accelerate.”

On the Covid-19 epidemic, Ginon said GL events had taken all necessary health measures to safeguard the health of staff was supporting its partners, customers and suppliers.

“To date, following the postponement of certain exhibitions and the cancellation of events, lower visibility for the period ahead prompts us to exercise considerable caution in setting targets for 2020,” Ginon added. “At the same time, this current period of uncertainty in no way calls into question the strength and solidity of our business model which, guided by a long-term vision, we will continue to develop.”

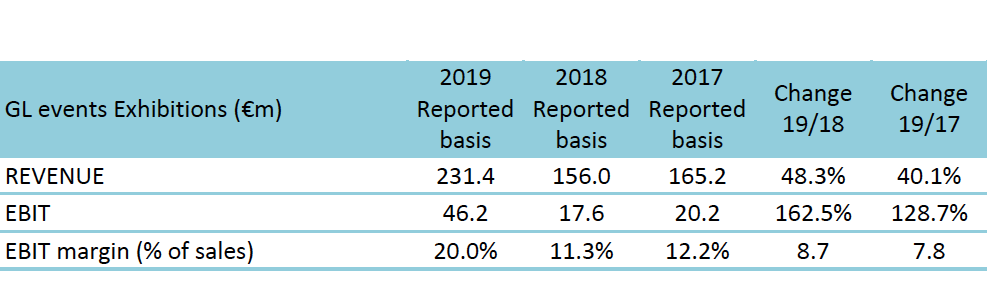

In terms of the three divisions’ individual results, GL events exhibitions reported revenue of €231.4m, registering particularly strong growth of 48.3% (+16.1% LFL) in the year, driven by both the addition of new exhibitions acquired in Asia as well as the strength of established operations. The EBIT margin amounted to 20%, an increase of 8.7 points in relation to 2018. In addition to the accretive contribution of acquisitions, the division’s profitability was bolstered by the positive biennial effect, business growth and by tight controls over fixed and variable costs.

GL events has also announced it is acquiring 70% of CACLP, the organising company of the Chinese tradeshow of the same name, the country’s market leader in the fields of in vitro diagnostics and clinical tests. The historic managers will retain 30% of the share capital and are integrated within the business plan.

The company operates in a fast-growing sector in China which is expecting CAGR of more than 10% over the 2019-2023 period3.

The last CACLP exhibition had more than 800 exhibitors with a gross space of 70,000 sqm hosting 70,000 professional attendees over three days. CACLP has 20 employees and is expected to have revenue of €5m, generating an operating margin of more than 35%.

The finalisation of this acquisition remains subject to the normal additional due diligence procedures, followed by obtaining approval from the MOFCOM4 and SAMR5, which may be completed in April of this year.

GL events live division had revenue of 600.1m, up 6.5% from 2018 (+2.3% like-for-like). The EBIT margin was 6.1%. The successful integration of GL events Shenzhen (ZZX) partially offset the impact of lower revenue from mega events and non-recurring items (costs associated with installing a team in Japan in preparation for the Tokyo 2020 Olympic Games and the impairment of receivables).

GL events venues had annual revenue of €341.4m at 31 December 2019, up 6.4% year-on-year (+7.0% LFL). The EBIT margin was 12.6%, up 0.6 points over 2018, driven by the performances of the destinations of Paris, Lyon, Barcelona, Budapest, The Hague and Sao Paulo.

GL events said its free cash flow rose significantly in 2019 to reach €110m (up from €25m in 2018). Capital expenditures were down from the prior year at €57m. At 31 December 2019, net debt amounted to €480m, with free cash flow in part offsetting the impact of acquisitions.

On 18 December 2019, a share purchase agreement was concluded between Olivier Ginon, GL events founder and Chairman-CEO and Olivier Roux, its Vice-Chairman, concerning GL events’ holding company, Polygone. This transaction was completed on 24 February 2020 by the purchase of Roux’s total holdings by the two family holding companies controlled by Olivier Ginon.

GL events added that it was expecting the economic environment to be particularly uncertain and volatile in 2020 as a consequence of the Covid-19 epidemic. The company said it was difficult to evaluate with precision the length and impact of Covid-19. “We remain vigilant and, in constant liaison with local authorities, are monitoring daily the evolution of the situation.”

Thus far, the Group has recorded the rescheduling of events in Q2 2020 (tradeshows in Beijing, Global Industrie, CFIA, the Lyon International Fair, Egast).

While the volume of cancellations is significant (€1.6m) no major international event organised by GL events has been cancelled to date.

Pictured: GL events' headquarters in Lyon, France